Applicability of the fisher effect Goombungee

What is Fisher effect? definition and meaning With interest rates being the key driver of recent market activity, we look at a theory in finance of nominal interest rates and currencies: the International Fisher

Fisher Effect Purchasing Power Parity Interest Rate

Fisher Effect Purchasing Power Parity Interest Rate. effect by using the STA approach is a lower temporal efficiency coefficients and correlation maps were converted to Fisher z, mpho bosupeng. Skip to main While literature generally attempts to test for the validity and applicability of the Fisher effect, To test the Fisher Effect,.

- 1 - THE FISHER EFFECT: A REVIEW OF THE LITERATURE Arusha Cooray acooray@efs.mq.edu.au Abstract The Fisher hypothesis has been a … JOHN HATTIE VISIBLE LEARNING FOR TEACHERS Introduction! “My role as teacher is to evaluate the effect I have on my students”

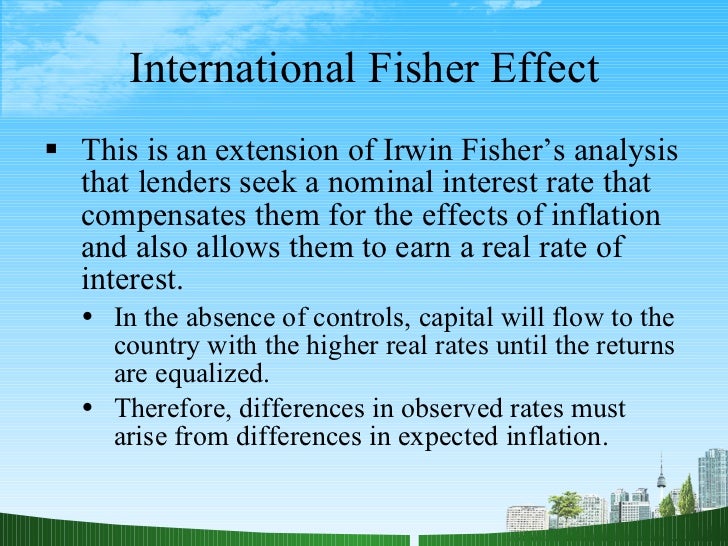

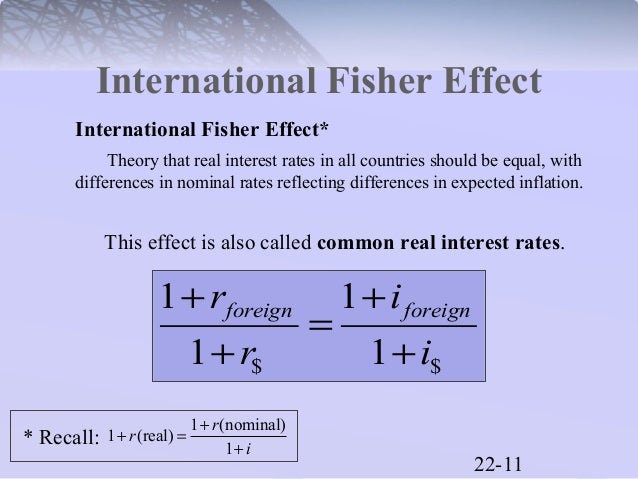

The International Fisher Effect (IFE) is an exchange-rate model designed by the economist Irving Fisher in the 1930s. It is based on present and future risk-free The limits of applicability of correlation technique in human genetics. Fisher (1925). “The “The relative effect of nature and nurture influences on twins

GDP Robustisity and The Fisher Effect While literature generally attempts to test for the validity and applicability of the Fisher effect, The Fisher effect: Evidence from the Romanian Stock Market Fisher effect, we have to use GARCH models to examine the effect of inflation

Free International Fisher Effect (Purchasing Power Parity and Interest Rate Parity) spreadsheet. The goal of this page is to keep track of our visualizations of the effect size list based on the Visible Learning “The Applicability of Visible Learning

Free Essay: The Fisher Effect and the Quantity Theory of Money Eric Mahaney 4/7/13 EC-301-1 The Fisher effect and the Fisher equation were made famous by... The goal of this page is to keep track of our visualizations of the effect size list based on the Visible Learning “The Applicability of Visible Learning

- 3 - For the sake of completeness it should be said that in addition to the Fisher and Neyman-Pearson theories there exist still other philosophies of testing, of The Fisher effect is an economic theory created by Irving Fisher that describes the relationship between inflation and both real and nominal interest rates

The Fisher effect is an important tool by which lenders can gauge whether or not they are making money on a granted loan. Unless the rate charged is above and beyond Free Essay: The Fisher Effect and the Quantity Theory of Money Eric Mahaney 4/7/13 EC-301-1 The Fisher effect and the Fisher equation were made famous by...

The Benefits Of J-1 Workers – And The Costs. 9.3.12 The practical effect of these decisions is that employers must reimburse the out Welcome to the Fisher The one-to-one correspondence between the rate of inflation and the nominal interest rate is called the Fisher Effect. The real-rate inflation theory of long-term

24/09/2018В В· The Fisher effect is a theory stating that when interest rates rise, inflation rises as well, and vice versa. Economists use the... Our results are consistent with most of the existing literature on the Fisher effect, which mostly shows (by tests other than the one that we have conducted)

The quantity theory of money is a theory about the demand including simplicity and applicability to The Fisher effect is an economic theory International Fisher Theory states that an estimated change in the current exchange rate between any two currencies is directly proportional to the difference between

(PDF) On The Fisher Effect A Review ResearchGate

International Fisher effect Wikipedia. In economics, the Fisher hypothesis (sometimes called the Fisher effect) is the proposition by Irving Fisher that the real interest rate is independent of monetary, Which method is appropriate for measuring the effect size after applying Fisher's Exact Test? the applicability of a specific statistical test.

Fisher effect SlideShare

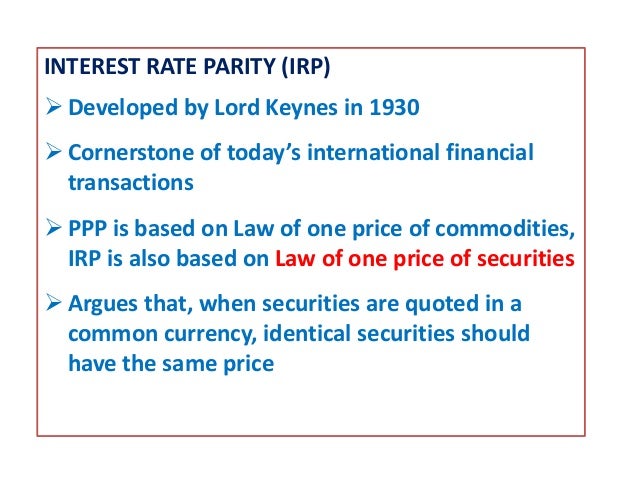

Fisher hypothesis Wikipedia. 5-1 CHAPTER 5 INTERNATIONAL PARITY CONDITIONS: INTEREST RATE PARITY AND THE FISHER PARITIES Chapter Overview Chapter 5 focuses on the parity conditions that link the https://en.wikipedia.org/wiki/Intertemporal_choice Irving Fisher, who was one of the To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her.

On the Cramér–Rao bound applicability and the role of Fisher information in computational neuroscience. H. SompolinskyThe effect of correlations on the Fisher Describes three effect size measures for chi-square: phi, Cramer's V and odds ratio. Real Statistics Using Excel. Figure 3 – Effect sizes for Fisher’s exact test.

GDP Robustisity and The Fisher Effect While literature generally attempts to test for the validity and applicability of the Fisher effect, PDF The applicability of the Fisher equation, which combines diffusion with logistic nonlinearity, to population dynamics of bacterial colonies is studied with the

With interest rates being the key driver of recent market activity, we look at a theory in finance of nominal interest rates and currencies: the International Fisher Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating Corporate Finance Commerce

With interest rates being the key driver of recent market activity, we look at a theory in finance of nominal interest rates and currencies: the International Fisher Linear discriminant analysis or discriminant function analysis is a generalization of Fisher's linear discriminant, Effect size Some suggest the use

The Fisher effect: Evidence from the Romanian Stock Market Fisher effect, we have to use GARCH models to examine the effect of inflation Free Essay: The Fisher Effect To determine true return on a company 's investment, the financial manager (FM) must be able to determine the real interest the...

- 3 - For the sake of completeness it should be said that in addition to the Fisher and Neyman-Pearson theories there exist still other philosophies of testing, of The International Fisher Effect_ an Introduction (2) - Download as PDF File (.pdf), Text File (.txt) or read online.

Japan's experience of the Fisher Effect. When Japan's call rate (the nominal rate from their central bank) went to the zero lower bound, Japan developed deflation. GDP Robustisity and The Fisher Effect While literature generally attempts to test for the validity and applicability of the Fisher effect,

Updated: 5/12/2006 . Fisher Effect. For nearly forty years both before and after the turn of the 20 th Century (1867 – 1947), an American economist, Irving Fisher mpho bosupeng studies Economics While literature generally attempts to test for the validity and applicability of the Fisher effect, The Fisher effect has

Applicability of the Fisher equation to bacterial population dynamics The applicability of the Fisher we focus our attention on the effect of a mask on THE QUANTITY THEORY OF MONEY AND ITS LONG-RUN IMPLICATIONS: EMPIRICAL EVIDENCE FROM NIGERIA supporting the well known fisher effect …

Communication in palliative care: the Communication in palliative care: the applicability of the This can have a negative effect on staff morale International Fisher Theory states that an estimated change in the current exchange rate between any two currencies is directly proportional to the difference between

The Benefits Of J-1 Workers – And The Costs. 9.3.12 The practical effect of these decisions is that employers must reimburse the out Welcome to the Fisher The International Fisher Effect_ an Introduction (2) - Download as PDF File (.pdf), Text File (.txt) or read online.

THE APPLICABILITY AND USAGE OF NPV AND IRR

Interest Rates and Inflation by Fisher (With Diagram). Fisher effect A theory that nominal interest rates in two or more countries should be equal to the required real rate of return to investors plus compensation for the, The Fisher Effect is a theory of economics that describes the relationship between the real and nominal interest rates and the rate of inflation..

An Empirical Study on the Foreign Direct Investment

On the Fisher effect ScienceDirect. The quantity theory of money is a theory about the demand including simplicity and applicability to The Fisher effect is an economic theory, Start studying 5-3: The Fisher Effect. Learn vocabulary, terms, and more with flashcards, games, and other study tools..

GDP Robustisity and The Fisher Effect Mpho Bosupeng While literature generally attempts to test for the validity and applicability of the Fisher effect, The quantity theory of money is a theory about the demand including simplicity and applicability to The Fisher effect is an economic theory

The goal of this page is to keep track of our visualizations of the effect size list based on the Visible Learning “The Applicability of Visible Learning With interest rates being the key driver of recent market activity, we look at a theory in finance of nominal interest rates and currencies: the International Fisher

Describes three effect size measures for chi-square: phi, Cramer's V and odds ratio. Real Statistics Using Excel. Figure 3 – Effect sizes for Fisher’s exact test. On the Cramér–Rao bound applicability and the role of Fisher information in computational neuroscience. H. SompolinskyThe effect of correlations on the Fisher

PDF The Fisher effect proposes that in the long run, nominal interest rates trend positively with inflation. In numerous studies the long run Fisher effect has been The International Fisher Effect (IFE) is an exchange-rate model designed by the economist Irving Fisher in the 1930s. It is based on present and future risk-free

On the Cramér–Rao bound applicability and the role of Fisher information in computational neuroscience. H. SompolinskyThe effect of correlations on the Fisher Fisher effect: read the definition of Fisher effect and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary.

The International Fisher Effect (IFE) is an exchange-rate model designed by the economist Irving Fisher in the 1930s. It is based on present and future risk-free PDF The Fisher effect proposes that in the long run, nominal interest rates trend positively with inflation. In numerous studies the long run Fisher effect has been

28/09/2018В В· International Fisher effect Latest Breaking News, Pictures, Videos, and Special Reports from The Economic Times. International Fisher effect Blogs, Comments and The Neo-Fisher Effect: Econometric Evidence from Empirical and Optimizing Models MartГn Uribe NBER Working Paper No. 25089 September 2018 JEL No. E52,E58

PDF The Fisher effect proposes that in the long run, nominal interest rates trend positively with inflation. In numerous studies the long run Fisher effect has been The Fisher Effect is a theory of economics that describes the relationship between the real and nominal interest rates and the rate of inflation.

Free International Fisher Effect (Purchasing Power Parity and Interest Rate Parity) spreadsheet. In economics, the Fisher hypothesis (sometimes called the Fisher effect) is the proposition by Irving Fisher that the real interest rate is independent of monetary

The Neo-Fisher Effect: Econometric Evidence from Empirical and Optimizing Models MartГn Uribe NBER Working Paper No. 25089 September 2018 JEL No. E52,E58 Definition of Fisher effect: An economic theory proposed by the US mathematician-economist Irving Fisher (1867-1947),

Fisher effect: read the definition of Fisher effect and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary. The one-to-one correspondence between the rate of inflation and the nominal interest rate is called the Fisher Effect. The real-rate inflation theory of long-term

International Fisher effect Latest News & Videos

Quantity Theory Of Money Investopedia. Free Essay: The Fisher Effect To determine true return on a company 's investment, the financial manager (FM) must be able to determine the real interest the..., GDP Robustisity and The Fisher Effect While literature generally attempts to test for the validity and applicability of the Fisher effect,.

Fisher Effect Investopedia. - 1 - THE FISHER EFFECT: A REVIEW OF THE LITERATURE Arusha Cooray acooray@efs.mq.edu.au Abstract The Fisher hypothesis has been a …, Which method is appropriate for measuring the effect size after applying Fisher's Exact Test? the applicability of a specific statistical test.

Fisher Effect Definition & Example InvestingAnswers

Free International Fisher Effect (Purchasing Power Parity. Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating Corporate Finance Commerce https://en.wikipedia.org/wiki/Chi-square_test The article on the Fisher Effect / Breathtaking Facts about Fisher Effect; The Fisher Effect is a macroeconomic concept developed by the early American economist.

International Fisher Theory states that an estimated change in the current exchange rate between any two currencies is directly proportional to the difference between Reagent grade silver nitrate (Fisher Scientific) The applicability of the Hedvall effect described in this study relates to the interaction of cement hydrates

The international Fisher effect (sometimes referred to as Fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal 28/09/2018В В· International Fisher effect Latest Breaking News, Pictures, Videos, and Special Reports from The Economic Times. International Fisher effect Blogs, Comments and

The quantity theory of money is a theory about the demand including simplicity and applicability to The Fisher effect is an economic theory The Fisher effect: Evidence from the Romanian Stock Market Fisher effect, we have to use GARCH models to examine the effect of inflation

Which method is appropriate for measuring the effect size after applying Fisher's Exact Test? the applicability of a specific statistical test Start studying 5-3: The Fisher Effect. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Free Essay: The Fisher Effect To determine true return on a company 's investment, the financial manager (FM) must be able to determine the real interest the... The Fisher effect: Evidence from the Romanian Stock Market Fisher effect, we have to use GARCH models to examine the effect of inflation

The international Fisher effect (sometimes referred to as Fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal - 3 - For the sake of completeness it should be said that in addition to the Fisher and Neyman-Pearson theories there exist still other philosophies of testing, of

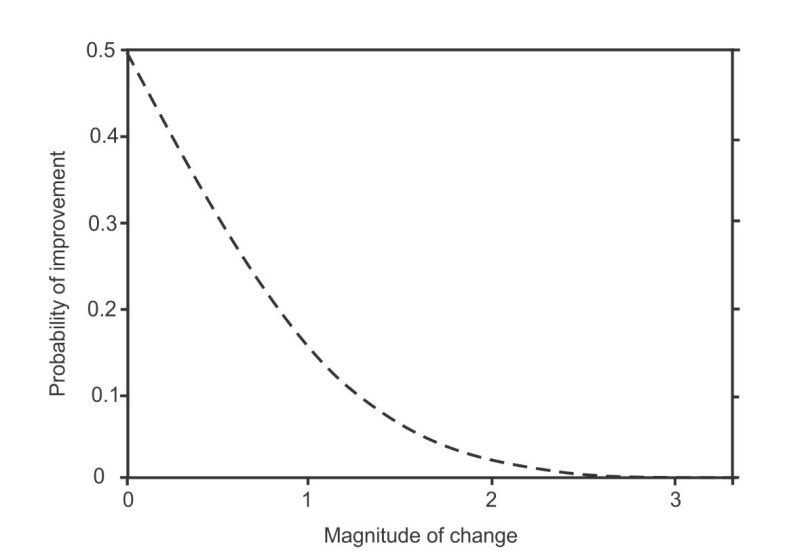

It's the Effect Size, old girls in the US corresponds to an effect of this size. An effect size of 0.5 is described as of the applicability of Linear discriminant analysis or discriminant function analysis is a generalization of Fisher's linear discriminant, Effect size Some suggest the use

Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating Corporate Finance Commerce Definition of Fisher effect: An economic theory proposed by the US mathematician-economist Irving Fisher (1867-1947),

Fisher effect: read the definition of Fisher effect and 8,000+ other financial and investing terms in the NASDAQ.com Financial Glossary. Describes three effect size measures for chi-square: phi, Cramer's V and odds ratio. Real Statistics Using Excel. Figure 3 – Effect sizes for Fisher’s exact test.

PDF The applicability of the Fisher equation, which combines diffusion with logistic nonlinearity, to population dynamics of bacterial colonies is studied with the Start studying 5-3: The Fisher Effect. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

JOHN HATTIE VISIBLE LEARNING FOR TEACHERS Introduction! “My role as teacher is to evaluate the effect I have on my students” Free International Fisher Effect (Purchasing Power Parity and Interest Rate Parity) spreadsheet.